Find a Partner Focused On YOU

You are proud of the company you’ve built. You deserve a partner focused on you and your objectives, with the experience to see them through.

Your Journey With ORG

Learn what it’s like to partner with ORG

Building the Relationship

Learn more about Building the Relationship

Industry Group PE Group Corporate Resource Group

What to Expect

Touching base on a quarterly or semi-annual basis to learn more about one another. ORG gets a better understanding of your business and how you want to grow, as well as your team and what makes your culture unique.

Why ORG?

You have a lot of options and it’s tough to distinguish one firm from another. This is why we often spend years getting to know companies and the people that comprise them. The process of building a relationship gives you the opportunity to see ORG in action over the course of time and how we work with our Partner Companies.

Official Stuff

Nothing

Timing: As long as it takes!

Understanding Your Goals

Learn more about Understanding Your Goals

Industry Group PE Group Corporate Resource Group

What to Expect

You will meet more ORG team members to get exposure to more of our firm, our culture and how we work together. Typically this includes one or several visits to your facility where we will listen to what you want to accomplish and provide more specific case studies and potential solutions to illustrate how our experience and resources can help you accomplish your goals.

Why ORG?

ORG is ideal if you and/or your business partners seek to sell a majority of your business to gain some liquidity, but remain invested to steer the company toward future growth opportunities and enjoy additional upside with the second “bite at the apple”.

Official Stuff

Nothing

Timing: 0 – 1 Year

Creating a Shared Vision

Learn more about Creating a Shared Vision

Industry Group PE Group Corporate Resource Group

What to Expect

At this point we have a good understanding of what you want to accomplish and we are all comfortable that we will enjoy working together to accomplish your goals and accelerate the growth of the business. ORG will put together and present our thoughts on how we can help you grow your business and execute on the plan. We’ll want your feedback at every step of the way. This phase can also include a formal indication of interest letter that details high level terms of a proposal for partnering together.

Why ORG?

We want you to know what you are getting into! At this point you may want to conduct reference calls to former and current Partner Companies of ORG.

Official Stuff

Indication of Interest letter and/or proposal presentation.

Timing: 0 – 1 Year

Structuring the Partnership

Learn more about Structuring the Partnership

Industry Group PE Group Corporate Resource Group

What to Expect

Partnership is an iterative process, and we will continue to work together until we have an understanding between both parties on a plan and structure that accomplishes the goals of the business owner and management team. At that point we will move toward presenting a formal letter of intent. After a signed letter of intent we will begin the diligence process and work toward making the investment.

Why ORG?

ORG works with you to craft a deal and structure where we all feel comfortable with the look and feel of the partnership.

Official Stuff

Letter of Intent; Purchase Agreement.

Timing: 6 Months – 1 Year

Creating Value, Together

Learn more about Working Together and Creating Value

Industry Group PE Group Corporate Resource Group

What to Expect

Prior to close we will work together to create a 100 day plan to jumpstart growth initiatives for the company. Typically within the first 30 days of our partnership, we will organize a strategic offsite with ORG and the core management team moderated by a facilitator to get uniform consensus on short and long term goals to tackle as part of the overall company growth plan. Then we’ll dedicate our teams to helping you grow your business.

Why ORG?

You and your team are on the same page with ORG working toward executing the long term vision for the company.

Official Stuff

100 day plan; value creation strategy; partner company playbook; quarterly/annual/multi-year goals from offsite.

Timing: 3 Years – 7+ Years

Exit and Beyond

Learn more about Exiting and Beyond

Industry Group PE Group Corporate Resource Group

What to Expect

Once we’ve collectively achieved the goals laid out together, we will collaborate on timing for what’s next for your business.

Why ORG?

After working together for so long, it would be weird to not remain friends.

Official Stuff

You’re gonna need a bigger bank account.

Timing: 6 Months – 1 Year

We’ve Supported Situations Like Yours

Every business is unique, so we have a solution that will fit you

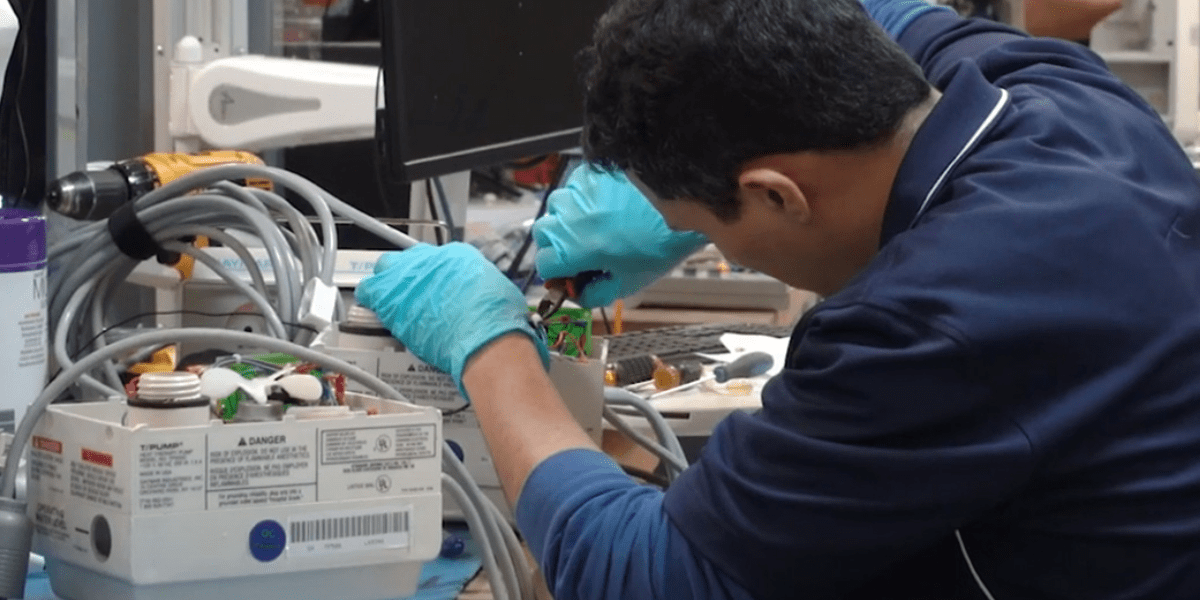

USMed-Equip (USME) is a regional provider of movable medical equipment primarily to hospitals

Gila Corporation (Gila) provides back-office services to government agencies on a local, state and federal level

Global Parts Distributors (GPD) is a leading regional distributor of automotive air conditioning components

K-Tec is a leading provider of direct mount and articulated dump truck pull / attachment scrapers

What Our Partnership Means For You

What does partnering with ORG mean? You maintain control over what matters most.

Your Company

We know you know the company best. You won’t have a boss – you’ll have a collaborator.

Your Culture

You’ve built something to be proud of. You care about your people. We’ll build on that legacy.

Your Future

This is a big financial, personal, and emotional decision. You control how involved you are, your role, the outline of the partnership, and your next steps.

What Else Makes ORG Different

We don’t just slap our core values on our website.

We live them every day. (Okay we slapped them on our website too)

Trust

Because this is the most important financial decision you’ll ever make.

Transparency

Because it’s your business – You deserve our clarity.

Collaboration

Because bigger things happen together.

Flexibility

Because you and your business are unique.