Second Quarter 2020 Review

First, we hope you and your family are happy, healthy and enjoying some return to normal life. We have all come very far since the onset of the pandemic and our collective strength and resolve to continue safe habits will see us through.

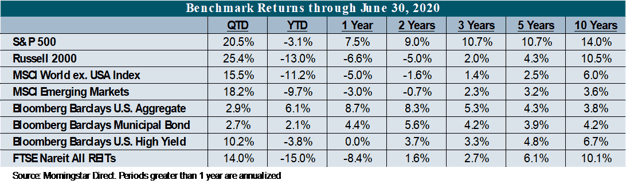

Capital markets rebounded strongly in the second quarter after the historical decline in the first quarter. The S&P 500 was up approximately 20.5% yet was still outdone by U.S. mid and small-cap index returns that exceeded those levels. Similar to the last few years, growth-style investing for the year-to-date period easily exceeded the returns of value-style investing: the Russell 1000 growth index returned 9.8% YTD, compared to -3.1% and -16.3% for the S&P 500 and the Russell 1000 Value Index, respectively. Non-U.S. developed markets were up approximately 15.5% for the quarter while emerging markets returned 18.2%. Within fixed income markets, the Bloomberg Barclays US Aggregate Bond Index was up 2.9% for the quarter, elevating its YTD return to 6.1% through June. Bonds have been a safe haven and a strong performer over the past year, generating a total return of 8.7% compared to the S&P’s return of 7.5%.

>The year is not complete, but it is safe to say that the future of investment strategy will be influenced by 2020 hindsight—remote possibilities such as the shutdown of the U.S. economy no longer is a “crazy thought”; markets can experience historical drawdowns in 23 days; tight employment markets can reverse to mass unemployment in weeks. We believe the economy is turning the proverbial corner, and longer-term we believe equity markets will be the best asset class to achieve client portfolio objectives. In the near-term, however, we believe risk management is incredibly critical as market moving information arrives in rapid fire, much of which is difficult to anticipate. As client fiduciaries, we believe alleviating downside risk is paramount. We continue to maintain a lower risk profile across client portfolios and will continue to do so until greater confidence in the U.S. economy re-opening develops and the ongoing COVID-19 threat becomes manageable in the context of everyday life.

The Big Picture

The Federal Government and the Federal Reserve have taken dramatic steps to support the U.S. economy. As we stated in a prior communication, while individuals across the country continue to wear masks for safety and health reasons, the U.S. economy continues to wear a protective mask in the form of monetary and fiscal policy.

In a recent Federal Reserve press conference, Chairman Jerome Powell stated that the economy continues to be fragile and that additional stimulus measures are in the best interest of the country. He further stated that interest rates will likely remain at their current levels through the end of 2022. This interest rate projection is consistent with the Federal Reserve’s dual mandate to achieve price stability (stable inflation) and full employment. In the near-term, both of these objectives are woefully below target and the Fed’s interest rate guidance is welcomed.

The capital markets appear to have accepted that first half 2020 U.S. economic growth will be lousy. First quarter real gross domestic product (GDP) was -4.8% and the second quarter is expected to show a drop of -32%. Perhaps more important is that many economists expect a significant recovery in the second half of 2020, which would allow the U.S. economy to decline only 5.6% for the year. If economic projections prove correct, the U.S. economy will recover to 2019 levels during 2022.[i] The markets appear to be “banking” on this outcome, although the recent spikes in regional COVID-19 infection rates are causing investors to revisit their assumptions. Understandably, many positive developments need to occur between now and then, the first of which is total control of the COVID-19 virus; it seems the common denominator in nearly every outlook discussion is when treatment and a vaccine become readily available.

The U.S. economy is not where it needs to be, but in our opinion it appears to be improving. One would hope this would have been the result after the passage of $3 trillion in stimulus funds—imagine if it didn’t help! Recent economic data has been somewhat favorable such as new jobs and a declining rate of initial jobless claims. We suspect much of the positive jobs data has to do with the paycheck protection program (PPP), the intent of which was for businesses to rehire laid off or furloughed workers. The risk to this progress is that post-June 30, 2020, the requirements of employers to continue paying employees via the paycheck protection program expires, providing the option of employers to again furlough or terminate employees. Certainly, as businesses look forward to the second half of the year with respect to demand for their products and services, declining sales or budget shortfalls could result in lower staffing levels. Some of this downside risk was recently alleviated by the extension of PPP application process through August 8, 2020, which allows small businesses to access Federal loans—employees and the economy remain safe as the “economic mask” is still on.

The Outlook

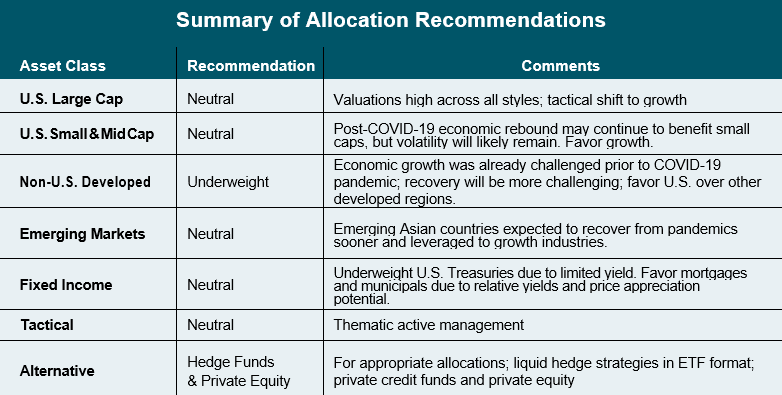

We maintain our neutral view on U.S. large cap equities. Current analyst consensus estimates of 2020 earnings for the S&P 500 are $125/share, however, excluding the information technology sector this figure drops to approximately $82/share. Consequently, growth-style investments remain critical for the achievement of the index’s earnings projections. For 2021 and 2022, analysts project $162/share and $189/share, respectively, for the S&P 500.[i] The current S&P 500 Index level of 3,179 implies forward P/E multiples of 19.6x and 16.8x for 2021 and 2022, respectively.[ii] If earnings materialize to these future levels and trailing P/E valuation levels remain stable, reasonable total returns through these dates may be expected. This brings us to a key risk: valuation. Currently, the S&P 500 and the Russell 1000 Growth and Value indices are all trading at historical premiums; the growth index is trading at about 33x 12-month forward earnings. As this paragraph started, S&P 500 earnings are heavily influenced by the information technology constituents and this will need to be closely watched. Ironically, if telecommuting becomes the norm, then it is reasonable to believe that information technology earnings will deliver and support market earnings. We are now entering 2Q 2020 earnings season and any positive guidance will likely be a strong catalyst for equity market appreciation. We expect the quarter will show disastrous earnings declines, but those results are likely factored into market prices.

We maintain our neutral view to small caps. While the asset class outperformed during the quarter, year-to-date returns remain down 13.0% due to the large drawdown during the first quarter. While we ultimately see small caps as a beneficiary in a recovery scenario, the recovery within small caps may be further off than large caps as the economic shutdown likely had an outsized impact on small cap fundamentals. As a result, and according to I/B/E/S data by Refinitiv, the market is now anticipating that companies within the S&P 600 will generate almost no earnings for the first half of 2020. While a recovery is anticipated in the back half of the year, earnings expectations have been dramatically reduced for the year from $65/share at the beginning of 2020 to just $20/share as of the end of the second quarter. The recovery is anticipated to continue into 2021 with full year earnings estimated to be around $40/share, but this is still lower than the approximate $50/share the index earned in 2019. Similar to large caps, the current valuations are elevated due to depressed earnings, but valuing off 2021 earnings does result in a more reasonable valuation that supports a larger allocation.

We recommend an underweight allocation to international equities, particularly as it pertains to developed markets. While developed markets gained 15.6% in the second quarter, the asset class is still down -11.2% year-to-date and trails its U.S. counterpart by 8.1%. We believe developed market economies will continue to face headwinds in a recovery, namely in Europe. According to the European Commission, Euro area GDP is expected to contract 8.7% in 2020, revised down more than a full percentage point from the previous estimate, with individual countries such as France, Italy and Spain estimated to contract more than 10% driven by the lack of tourism in the region. While many countries have produced fiscal stimulus and relief packages, it is likely more action will need to be taken by the European Union and ECB to adequately combat the economic hardships.

Within emerging markets, we take a slightly more constructive view and thus recommend a neutral allocation. The decline in earnings estimates within emerging markets is roughly half of what is being experienced for developed market companies, driven by Asia. This is likely driven by a few beneficial factors. Asia appears to have more effectively controlled the COVID-19 outbreak in the region and thus has been able to reopen the economy at a higher capacity. Additionally, Asia has a higher disposition to growth industries (e.g., technology, communication services and consumer services) and thus is relatively advantaged in the current environment. As a result, we continue to favor Asia within our emerging markets allocation. However, risks remain in the region that we continue to monitor. For instance, Hong Kong introduced a new national security law put forward by China, which extends the Chinese government’s influence into the region and has created backlash with many large multinational tech firms, leading them to suspend data compliance with Hong Kong authorities.

Fixed income markets marched higher during the quarter, aided by a rally in spread products. Treasury bonds experienced a return of about 0.5% as rates were mostly stable during the quarter but are up 8.7% year-to-date due to the strong first quarter rally. Investment grade corporate bonds led during the quarter with a return of 9.0% as spreads returned to more normalized levels, albeit still higher than where they entered the year. The positive return helped reverse negative performance from the first quarter and the sector is up 5.0% year-to-date, primarily due to lower rates. The broad municipal bond index was up 2.7% for the quarter but shorter duration municipals outperformed due to the normalization of the market that experienced severe stress in March. Mortgages slightly outperformed Treasuries for the quarter with a return of 0.7% as concerns surrounding mortgage forbearance reemerged. Below-investment-grade bonds also rallied during the quarter with a return of 10.2% for high yield and 9.7% for leverage loans. However, unlike the investment grade sectors, these sectors remain down about 4% for the year given that they are tied more to risk appetite like equity markets. Moving forward, we see little opportunity in Treasury bonds given the limited yield and favor areas like investment grade mortgages and municipals as they have lagged other areas of the market. These areas continue to offer attractive relative yields and have the potential to outperform with price appreciation provided there is marginal improvement in the economy.

Our Tactical recommendation continues to include investments in an active thematic investment manager. The manager holds a portfolio of companies in businesses engaged in sectors perceived to have significant growth potential such as network modernization, digitization of commerce, life sciences and sustainable retail formats. Please speak with your Wealth Advisor regarding thematic investments.

Tax and Financial Planning News

The Fed’s policy decision to reduce rates to 0.0%-0.25% in March created several financial planning opportunities for clients and their families. Mortgage rates have steadily declined in 2020 and have settled around 3.25% for a 30-year mortgage. For those who have not refinanced in a number of years or are looking to borrow against their home’s equity, now is a great time to lock in historically low 30-year rates. In addition to that opportunity, lower interest rates also make gift and wealth transfer strategies more attractive. Strategies like intra-family loans, installment sale notes, and Grantor Retained Annuity Trusts (GRATs) are all sensitive to the AFR rates, which in July, were between 0.18% and 1.17% (short-term vs. long-term). A low interest rate environment makes these strategies more appealing for borrowers/recipients as the costs decrease significantly. Lastly, lower interest rates also translate to lower costs on margin amounts in investment portfolios. For clients looking to add leverage to their investment accounts, we are observing rates as low as 2.1% and the interest can be tax deductible. Please reach out to your Round Table Wealth Advisor to further discuss how you can make the most of this low interest rate environment.

[i] JP Morgan

[ii] S&P 500 Index level as of July 7, 2020

[iii] Philadelphia Federal Reserve

*The content herein is provided to you on an as-is basis without any warranties of any kind. In no event shall Owner Resource Group, LLC be liable for any direct, indirect, incidental, punitive, or consequential damages of any kind whatsoever with respect to this content. The content is not intended to provide investment advice. We strongly recommend you consult professional business advisors before making any financial or investment decisions.