Owner Resource Group is pleased to provide the following wealth management insights from Round Table Wealth Management.

Owner Resource Group is pleased to provide the following wealth management insights from Round Table Wealth Management.

Third Quarter 2021 Review

Dear Clients and Friends,

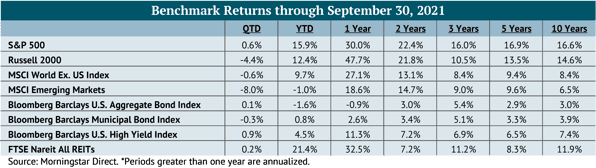

We hope you had a wonderful summer and were able to gather with family and friends once again. As the world emerged for summer vacations, capital markets were relatively calm. However, issues brewing under the surface for much of the year including inflation, a Federal debt limit impasse, supply shortages, shipping logistics and labor shortages all drew increased scrutiny in investors’ minds during September, contributing to heightened volatility within markets. Despite these post-Labor Day headwinds and setbacks, capital markets have performed well year-to-date, generating a return of 15.9% for the S&P 500 through September 30 while the bond market is down approximately 1.6%.

Following the strong trailing returns and with more risks on the horizon, we believe equity and bond market returns will likely be more moderate over the short to intermediate time horizon. Since April 2020, investors have reaped the benefits of equity exposure as earnings and valuations have surged to record levels. The market’s rebound off the bottom and today’s high valuations are consistent with prior recoveries post-recession. Historically, during a recovery, market valuations gradually subside as earnings regain momentum. Today, however, valuations remain high and operating earnings are also at historically high levels. For valuations to revert along historical patterns, earnings growth will necessarily need to continue its current trajectory. We are constantly evaluating new data as it becomes available and considering how it will impact our investment outlook. Consequently, while our portfolio positioning has not materially changed since last quarter, new developments across macro factors may lead us to alter allocations and risks in the near-term. Please reach out directly to your Wealth Advisor to discuss our outlook or any concerns you may have.

The Big Picture

As we enter the final quarter of the year, forward looking economic data remains encouraging. During the second quarter (third quarter not released), U.S. real GDP increased by 6.7%. [1] Estimated U.S. economic growth for the third and fourth quarters is 6.8% and 5.2%, respectively, which implies a yearly growth rate of 6.1%. Based on economist projections for the next two years, U.S. economic growth slows to 4.4% in 2022 and 2.5% in 2023. [2]

Historically speaking, these figures are reasonable levels of economic growth; however, complexities such as global supply bottlenecks and related manufacturing and inventory issues could add uncertainty to these forecasts. As demand continues to remain robust but is met with supply shortfalls, price increases may occur suggesting that inflation is no longer “transitory” but perhaps “prolonged.” Higher retail prices theoretically should temper spending and are also likely to impact future realized market returns.

Exacerbating market worries is the continuing tug-of-war in Washington over infrastructure spending and the Federal Debt Limit impasse. With respect to the debt limit, Washington has as of this writing passed a temporary increase through December 2021. This did not come as a surprise to us as the limit is regularly increased and no elected official actually wants to see the U.S. default on its debt obligations. With respect to the $3.5 trillion infrastructure legislation, “Build Back Better,” we believe the idea of infrastructure investment is welcomed by both political parties, but obviously the price tag is not. Ultimately, we believe a package perhaps with a lower price tag, will be passed.

As you are likely aware, throughout the year, inflation has continued to be an on-again/off-again concern impacting equity markets. Reflecting back to the start of the year, inflation expectations rose followed by increases in interest rates, specifically the U.S. 10-Year Treasury Bond, which many investors use as a barometer for future inflation. It was during that time that growth-style equities sold-off and value-style investments performed relatively well. This dynamic changed during the May and June timeframe as investors shrugged off inflation concerns, which in turn helped growth-style investments perform well. More recently, the compounding issues in global supply chains and low inventories combined with labor shortages and wage increases have pushed up inflation expectations dramatically. Consequently, interest rates have moved higher, with the U.S. Treasury 10-year bond reaching approximately 1.6% (for perspective the 10-year Bond yield was 1.17% in early August). These developments spawned equity market volatility in September similar to that experienced at the start of the year, which saw growth-style investments sell-off dramatically while value-style investments held up relatively well. We are actively assessing the potential for above-consensus inflation increases and simultaneous interest rate increases. Despite the outlook for potentially higher interest rates, we continue to favor equities over fixed income.

The Outlook

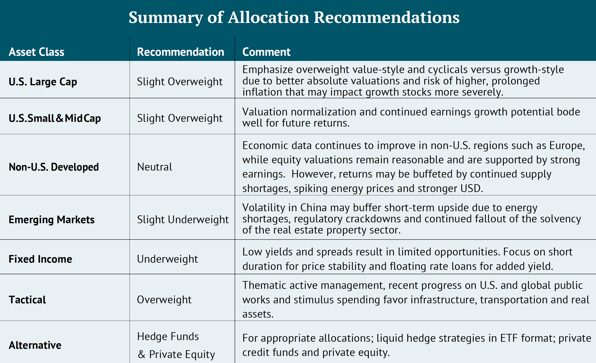

We remain overweight to U.S. large cap equities, with a bias toward value-style and cyclical investments. Today, the large cap market is characterized by valuations in excess of historical levels. While unsettling, this is not uncommon during economic recoveries. After the last four recessions, price-to-earnings valuations generally spiked as earnings dropped to trough levels and investors rightfully bought shares on the premise that earnings would recover and valuations would normalize. This is what we see occurring today. Of concern is that valuations are high post-recession and operating earnings have reached a higher level than those of prior business cycles. The question now is: “Is the next earnings move up or down from here?” On the optimistic side, consumers remain flush with cash and retail spending data is strong. We also put forth that the U.S. will continue to push for infrastructure spending and new initiatives to realign the US economy with a more climate friendly approach; all of this requires massive spending. If inflation becomes “prolonged” rather than “transitory,” we believe value-style and cyclical investments should perform better than growth-style investments, whose distant cash flows will be discounted more heavily as interest rates rise. Irrespective of style, companies will either need to push through cost increases to maintain current projected earnings growth or find more operational efficiencies.

We maintain a favorable outlook on the small and mid-cap equity asset class. Fundamentals such as earnings growth and valuations remain the primary drivers of this outlook. Like large caps, small caps have seen earnings sharply increase from the depressed 2020 levels, with 2021 earnings expectations to be nearly 30% higher than 2019 earnings according to data compiled by Nasdaq. However, unlike large caps, the risks surrounding valuations are more muted as the normalization of valuations appears to have occurred over the last couple of quarters. Small cap returns have been mostly flat during the second and third quarter of 2021 as earnings growth was countered by multiple contraction. For example, the S&P 600 had a forward P/E valuation of 22.2x at the end of the first quarter, roughly 25% higher than where it ended the most recent quarter at 16.8x. During this same time period, annual estimated earnings on the index increased over 30%. While there are other factors that influence index returns such as dividends and share issuance/buybacks, valuation compression was the primary headwind for returns over the last six months since earnings have been so strong. This is commonly referred to as a “consolidation period” and it is normal and healthy to experience as expectations are recalibrated. Going forward, we continue to see a path forward for higher earnings but see less of a headwind from valuation compression as forward earnings are now in line with historical ranges, which should help bolster potential returns in the asset class going forward. We are also mindful that 1) small cap equities generally perform well during economic recoveries and 2) that current global supply chain issues could spark a wave of partial manufacturing “re-shoring” in order to diversify supply sources (the Biden administration also favors this). Both of such potential developments could bode well for the SMID Cap asset class.

We continue to recommend a neutral allocation to non-U.S. developed market equities. The economic recovery in developed markets continues to gain traction, highlighted by the European Central Bank raising its 2021 GDP growth estimate for the region to 5%, up from the previous projection of 4.6%. [3] We believe the opportunity for developed markets equities is improving as the overweight exposure to value sectors remains a beneficiary of the global recovery and is coupled with continued dovish monetary policy at a time when the U.S. Federal Reserve is appearing to turn more hawkish. In addition, international equities currently present a few fundamental characteristics compared to the U.S. that support allocation to the region. First, international equities do not exhibit the same valuation concerns that are evident in U.S. The forward-looking price-to-earnings ratio for international equities, as measured by the MSCI ACWI ex. USA Index, is 14.3x, representing a 29% discount to the P/E ratio in the U.S. The current discount is more than two standard deviations below the average historical discount of 13%. [4] This is supported by superior earnings growth as well, as EPS growth projections in Europe for 2021 and 2022 are expected to outpace EPS growth in the U.S, according to analyst estimates from JP Morgan. In efforts to capitalize on the improving dynamics in developed markets, we have initiated an allocation to small and mid-cap companies, which have historically been leveraged to accelerating economic activity and represents a similar positioning stance we undertook within the U.S. earlier this year. While the investing landscape is improving in developed markets, we maintain a neutral weight given near-term headwinds caused by continued supply shortages, rapidly increasing energy prices, and a stronger U.S. Dollar that may mute returns.

In emerging markets, we have reduced our recommendation to a slight underweight allocation. While the long-term growth opportunity in emerging markets has not changed, we believe the near-term outlook presents more risk, particularly in relation to China. In our opinion, the largest headline risk within China is the increased regulatory crackdowns on specific industries and companies as the government looks to take more control over social issues. Market sentiment has retreated in recent months due to the uncertainty around the timing and scope of future regulation. Additionally, China has seen a slowdown in economic activity driven from a combination of their zero-tolerance COVID policy and mounting energy shortages throughout the country. This has led to the repeated shutdown of localities, factories, and shipping ports. In September, China’s manufacturing PMI fell below 50, denoting a contraction in output for the first time since the onset of the pandemic. Meanwhile, the latest reported retail sales growth in China came in at 2.5%, the slowest rate in over a year, and well below analyst expectations and prior month figures. [5] While these economic disruptions may prove to be temporary, their impact has rippled out to the global economy, putting further strain on already beleaguered supply chains, and exacerbating supply shortages globally.

We are maintaining client portfolio exposure to real assets/commodities via liquid exchange traded funds and mutual funds. Our exposure contemplates the commodities value chain from raw commodities to transportation to infrastructure companies. We believe the allocation takes into consideration the potential for rising inflation as well as “following the money” with respect to governmental largesse.

Fixed income remains an underweight in portfolios given limited yield opportunities and elevated risks associated with the current low interest rate environment. Rate movement during the quarter was volatile, with the primary driver being any data points that may shift decisions of Federal Reserve on when to taper bond purchases or increase rates. While rates steadily declined for most of quarter as inflation fears abated, rates quickly reversed higher following the September meeting of the Federal Reserve, where it was announced that they were now starting to talk about the tapering process. The news sent 10-Year rates nearly 25 bps higher over the course of a week and resulted in rates ending the quarter 2 bps higher than where they ended the previous quarter. At the same time, inflation expectations moved almost in lockstep with nominal rates, meaning that the higher inflation expectations may be the primary driver of higher Treasury yields. Inflation remains one of the biggest risks to bond and equity markets, as market participants struggle to conclude when supply chains will normalize. While the majority continue to see the current inflation environment as transitory, concerns that it may persist for longer than originally anticipated are increasing. Some supply chain constraints in markets like lumber have abated, but new constraints and elevated prices in markets like European natural gas are now occurring. Given these dynamics, we are evaluating additional actions within portfolios that could be taken provided continued “rolling supply chain distributions” that would keep inflation elevated for longer.

Tax and Financial Planning News

While it appears to still face an uphill battle in Congress, the House Ways & Means Committee introduced new tax legislation that would implement many of the changes President Biden campaigned on in 2020 and proposed earlier this year. This legislation offers the most recent insight into what changes could impact investors and their portfolios in 2022. Most notably, on the income tax side, the highest marginal rate will increase from 37% to 39.6% and there will be a 3% surtax for earners with more than $5mm of income. The top capital gains rate would increase from 20% to 25% (as proposed, to occur on September 13, 2021). There would also be a significant reduction to the existing estate tax exemption, currently at $11.7mm, and some of the tools used for estate planning purposes would be disallowed in the future. For a more comprehensive overview and analysis of the proposed tax changes, please read our recent blog on the topic.

Firm News

Round Table has relocated its New York office. Our new address in the city is One Rockefeller Center, 10th Floor, New York, NY 10020.

[1] Bureau of Economic Analysis, September 30, 2021.

[2] Philadelphia Federal Reserve, Survey of Professional Forecasters, August 13, 2021

[3] IMF, World Economic Outlook: October 2021 Issue

[4] Bloomberg. Data as of September 30, 2021

[5] Trading Economics, September 30, 2021

*The content herein is provided to you by unaffiliated sources believed to be reliable, but not guaranteed on an as-is basis without any warranties of any kind. In no event shall Owner Resource Group, LLC be liable for any direct, indirect, incidental, punitive, or consequential damages of any kind whatsoever with respect to this content. The content is distributed for informational purposes only and not intended to provide investment advice. The information contained in this article is accurate as of the data submitted, but is subject to change. We strongly recommend you consult your professional business advisors before making any financial or investment decisions.