Owner Resource Group is pleased to provide the following wealth management insights from Round Table Wealth Management

Fourth Quarter 2021 Review

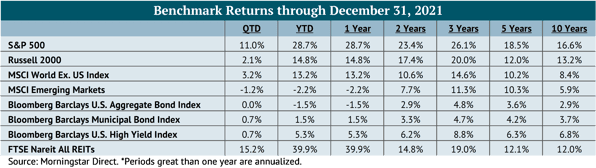

Once again, equity markets had a great year with the S&P 500 posting a 29% return and a 3-year annualized return of 26%! The equity market returns are even more impressive in light of inflation concerns throughout the year, labor shortages, supply bottlenecks and the mutating COVID-19 virus. As we look toward 2022, our view is that many of these risks will continue and some specifically will have a more critical influence on market returns. While we would love to see a repeat of 2021 markets, our expectations for the year ahead calls for more moderate equity market returns, as well as investment grade fixed income returns being somewhat muted due to the high probability of rising interest rates.

The Big Picture

According to the Federal Reserve, the U.S. economy is expected to grow at 5.5% in 2021 and continue its strength through 2022 with an expansion of 4.4%, which will be recorded as some of the strongest U.S. GDP growth in several decades. During its most recent press conference, Federal Reserve Chair Jerome Powell’s disposition towards inflation pivoted as he cited the strength of the U.S. economy, the improving labor and employment picture and the resiliency of household balance sheets. He specifically stated with respect to the Fed’s dual mandate that inflation had achieved its long-term average above 2% and the labor market was “rapidly approaching full employment.” This development was consistent with our 4Q 2021 Investment Outlook and Positioning webinar statement when we pointed out historical periods of inflation and employment and coincident Fed actions implied the Fed effectively had “–permission to act.” With inflation no longer viewed as “transitory” and the Fed’s marginally more hawkish view, investors are correctly focusing on the Fed’s views of inflation and the trajectory and intent to increase interest rates. The Fed minutes from its December 15, 2021 meeting state that the Fed Committee voted to approve accelerating its reduction in bond purchases and end them by March 31, 2022.

While the Fed unanimously approved keeping its Fed Funds Rate unchanged at 0% to 0.25%, they kept the option to raise rates sooner and implied that it would occur after it ceases bond purchases. The Fed made no mention of when they would raise rates, but market participants are expecting three interest rate increases in 2022 with a number of economists anticipating the first rate increase in March. The Fed Committee consensus is that the Fed Funds Rate will reach about 90 bps by year-end 2022 and reach its longer-term range by year-end 2024. As you may have witnessed, markets interpreted the Fed’s statements negatively. Growth-style investments with high equity valuations and more distanced future cash flows sold-off materially. It is this type of macro-induced volatility that we believe will be more pronounced in the year ahead as changes to the Fed’s inflation outlook and management of interest rates comes into greater focus.

Inflation does not happen without strong consumer demand. The U.S. consumer, the backbone of the U.S. economy, continues to spend as evidenced by the latest official reports showing retail spending increased 18.2% year-over-year (YoY) through November 2021. The December 2021 Retail Sales growth figure was negative, reducing the YoY figure to 16.9%, but was likely influenced by the rapid spread of the Omicron virus and inventory shortfalls. A key concern with respect to consumer spending is the termination of many direct government cash transfers and other policies that sustained and increased consumer cash balances and therefore spending power during the pandemic. Policies such as mortgage forbearance, rent deferment, student loan payment deferrals, and enhanced unemployment benefits have ended or will soon. These policies allowed households to save about $1.6 trillion and had an immediate impact of putting cash back into the economy directly as cash recipients or policy beneficiaries used the cash/savings to meet expenditures. Whether or not such spending continues at the same pace is a dynamic we are monitoring. An important dynamic offsetting this concern is rising wages.

According to the Bureau of Labor Statistics, hourly wages for employees rose at 4.8% YoY, which is higher than any period pre-pandemic going back to 2007. Further to the point, a survey by the National Federation of Independent Businesses shows that 48% of small businesses are raising compensation and 32% plan on boosting compensation in the next three months; both are at record levels by significant amounts. It could be that rising wages and improving workforce participation will provide the needed support for continuing consumer spending while Federal policy trails off. If this is the case, and we suspect it is, then we would expect goods and services demand to remain strong, inflation to remain elevated and the Fed to act accordingly. In such a scenario, corporate earnings could materialize in line with analysts’ projections, and provided valuations are not materially impacted by rising rates and inflation, we would expect equity market returns to be positive.

The Outlook

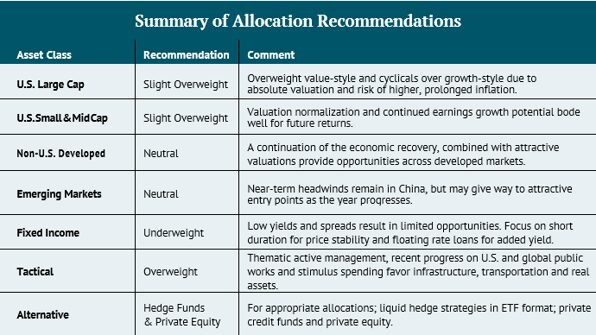

We continue to hold a slight overweight to U.S. Large Cap equities. We believe large cap equity market returns will be more in line with historical averages in 2022 and yet may continue to outpace non-U.S. developed market peers. Equity market valuations, in general and by style specifically, lead us to recommend an overweight to value-style investments relative to growth-style investments. While growth companies are likely to maintain healthy earnings momentum in the coming year, rising interest rates and inflation may act to depress premium valuations and therefore restrain positive share price performance relative to value-style investments. (This was clearly demonstrated in early-January 2022). Based on Bloomberg data, the Russell 1000 Growth Index (RLG) is anticipated to increase earnings by about 13.2% in 2022, while the Russell 1000 Value Index (RLV) is expected to increase earnings by 9.3%. With that said, the RLG is trading at a trailing 12-month price-to-earnings ratio (P/E) of 38.3x relative to a comparable 20.1x for the RLV. If the respective P/Es of RLG and RLV migrate towards their 10-year averages of 24.8x and 17.4x, we would expect growth-style investment performances to trail those of value-style investments.

We continue to hold an overweight to small and mid cap equities. While the asset class failed to keep up with the S&P 500 in 2021, it managed to generate returns of 14.8% and 22.6%, respectively, as measured by the Russell 2000 Index and Russell MidCap Index. Importantly, the underperformance relative to large cap was driven by multiple compression and not disappointing fundamentals. In fact, small caps far exceeded the annual revenue expectations that were set out at the beginning of 2021 of around 7% and are now expected to see annual revenue growth of about 17% in 2021. According to Bloomberg Intelligence, revenue growth is anticipated to remain above average in 2022 with forecasted annual growth of 7.6%, an estimate that incorporates rising yields and 4.5% real GDP growth. This is a material premium to the 1.9% average annual revenue growth since 2001 and we anticipate it will be a key driver of returns for the year ahead as we are not anticipating multiples to contract further from here. Instead, we would anticipate valuations to be stable as multiple expansion will be difficult in an environment with less accommodative monetary policy. However, with the asset class trading at a 26% discount to large caps and a 16% discount to its 5-year historical average as measured by S&P indices, we believe this can help establish a valuation floor within the asset class, clearing the way for fundamentals to drive prices.

With the beginning of a new year, we maintain a neutral allocation to non-U.S. developed market equities. Developed markets delivered strong absolute returns in 2021, gaining 13.2%, but materially trailed another stellar year for the S&P 500. Currency was one of the contributors to the underperformance of developed market equities, detracting roughly 6% from U.S. Dollar-denominated returns. While performance trailed the U.S. over the course of 2021, earnings growth overseas rebounded strongly and is expected to keep pace in 2022. As a result of strong earnings yet subdued price appreciation, valuation multiples compressed and led to a significant discount of developed market valuations compared to domestic markets. For example, at yearend, the forward-looking P/E ratio of the MSCI World ex USA Index was trading at a 30% discount compared to the S&P 500, more than two standard deviations below the historical average discount of 12%. Additionally, with expectations that supply chain bottlenecks should ease as the year progresses as well as moderating news around the Omicron variant, the global economy should carry on its recovery and provide a cyclical tailwind to non-U.S. markets. While we believe there are improving opportunities in developed markets, a variety of risks remain ranging from continued inflation, additional COVID variants, missteps in central bank policy, or geopolitical risks (e.g. Russia/Ukraine or China/Taiwan).

Within emerging markets, we are improving our recommendation to a neutral allocation. Returns in emerging markets were negative in 2021, a stark contrast to the rest of the world. The negative performance was primarily due to the volatility within China. Regulatory crackdowns, restrictive COVID policies, and surging energy costs created a perfect storm that resulted in Chinese equities declining 22% in 2021. These risks remain as we head into 2022, but it appears that regulatory action may have peaked in the second half of last year and the Chinese central bank, the People’s Bank of China, is likely to introduce stimulus measures to support the economy and capital markets. Emerging markets present intriguing long-term investment opportunities with relative valuations to developed markets at historical lows and earnings growth on par with U.S. equities.

We recommend an underweight to fixed income as we enter 2022, although we recognize this outlook can reverse quickly should rates continue their trend higher from the post-Omicron lows. By early-January, the 10-Year Treasury bond had breached 1.75%, taking out 2021 highs and back to levels last seen pre-pandemic. As we see elevated volatility in all bond maturities, we continue to concentrate capital in short-term bond and floating rate loan strategies. Short-term bond strategies provided capital preservation in the face of higher rates in 2021 but did not generate much in terms of yield as rates were depressed for much of the year. However, with the market pricing in the anticipated hawkish actions of the Fed mentioned above, short-term rates have risen in recent months, allowing for investors in short-term strategies to earn a reasonable yield while continuing to sidestep much of the rate volatility we have seen over the last few months. Our allocation to floating rate strategies provided a much-needed boost to fixed income yields in 2021 and we continue to expect that they will provide an attractive income stream for portfolios in 2022 as the expectation is that yields will increase as short-term rates increase. We see this two-pronged approach to fixed income investing as an appropriate strategy in a year where rate volatility is expected to remain elevated.

We are maintaining client portfolio exposure to real assets/commodities via liquid exchange traded funds and mutual funds. Our exposure takes into consideration the commodities value chain from raw commodities to transportation to infrastructure companies. We believe the allocation takes into consideration the potential for rising inflation as well as “following the money” with respect to governmental largesse.

*The content herein is provided to you by unaffiliated sources believed to be reliable, but not guaranteed on an as-is basis without any warranties of any kind. In no event shall Owner Resource Group, LLC be liable for any direct, indirect, incidental, punitive, or consequential damages of any kind whatsoever with respect to this content. The content is distributed for informational purposes only and not intended to provide investment advice. The information contained in this article is accurate as of the data submitted, but is subject to change. We strongly recommend you consult your professional business advisors before making any financial or investment decisions.